|

The number of days that have passed since the beginning of the New York on PAUSE (March 23, 2020)

Most of the functionality of the local real estate market has been restored under Phase 2 of the NY Forward reopening plan. Access to properties by all parties is now allowed. We’ll have to wait-and-see the extent to which the public is willing to engage in house shopping and house buying as the market opens back up and the pandemic numbers drop down. In terms of my predictions about Phase 2: I was wrong before I was right and then, in the end, I was partially right or partially wrong depending on how you look at it. Read all about it below. As always, I am available to talk privately with you about your particular real estate situation. Call, text or FaceTime: 585-732-1767. Email: romecelli@realtor.com I host a weekly Zoom meeting to answer your general questions about the local real estate market. Mondays at 8:00 pm EST CLICK HERE TO JOIN THE MEETING Meeting ID: 585 732 1767 Password: 954010 Phase 2 of NY Forward comes to the Finger Lakes Region and Rochester. At a few minutes after 1:00 pm on Friday, May 29th Governor Andrew Cuomo announced the Finger Lakes region - including the Metro Rochester area - would move to "Phase 2" of NY Forward, the governor's incremental plan to re-open the economy in New York State. The residential real estate sector in our area would be allowed to expand it's operations with certain notable limitations as of yesterday, Saturday, May 30th. Here’s the executive summary of what’s allowed (with restrictions described below) in the residential real estate sector during Phase 2:

Download and read this file if you want to know all the gory details of Phase 2 as it relates to the real estate business.

A closer look at what’s allowed for residential real estate under Phase 2: There are two main areas for you to understand about residential real estate during Phase 2: the administrative functions in real estate AND the interactions with real estate clients and the public at large. I'll very briefly touch on the administrative side before digging in on the new rules related to interacting with clients and the public. With respect to the administrative side of the business all real estate companies must submit detailed plans for how they will operate and interact with each other, clients and the public. Offices staff must minimize interaction, wear masks, keep social distancing standards and sanitize everything in sight. Visitors on-site at real estate office are prohibited except when it cannot otherwise be avoided. COVID testing and contact tracing are embedded in the regulations. This phase should be implemented in steps over time rather than all-at-once. What follows is a deeper dive into property showings and related activities: Responsible Parties (real estate brokerage companies and agents) may conduct in-person property showings while adhering to social distancing and required PPE safety guidelines. The following measures must be followed:

Responsible Parties are encouraged not to show common building amenities in-person (e.g. gym, roof deck, pool).

Responsible Parties should encourage only one party (e.g. building inspector, home appraiser, prospective tenant/buyer, photographer, stager) to be allowed inside the property at a time. If more than one party is inside the property at the same time, 6 feet of distance must be maintained at all times between individuals, and face coverings must be worn.

Responsible Parties are encouraged, but not required, to conduct remote walkthroughs rather than in-person walkthroughs (e.g. recorded/live video), where possible. Analysis, Musings & Reflections. First, in my opinion, these changes open the real estate market up significantly. While market access and functionality may not be back to where it was on January 1st it’s pretty close. Now, the most significant impediment will be consumer fears/concerns. I expect the volume of listings and transactions to rise quickly. The market may well return to about 85% to 90% of the normal pace for June - higher in July and August. The market probably will not reach full steam until later in 2020. Back in mid April when I was attempting to predict the future I did not expect in-person appointments with clients and the public by now. I thought we’d get to that point in July or so. I didn’t expect even limited “open houses” until later in the year. Then, after seeing the COVID related numbers drop I began to think in-person appointments would be allowed in Phase 2. At no time did I expect any variation of “Open Houses” to be permitted during Phase 2. Although Open Houses are efficient in the sense that they allow many prospects to look at a property in a very short period of time why allow such risky behavior when prospects can preview properties online and otherwise schedule an appointment? Well, probably because there was no way to define an in-person property viewing - even one-at-a-time - without it being applied in a manner similar to an open house (e.g., 2-3 pm on a Saturday afternoon). So, I guess it makes sense from a practical point of view. In my opinion Open Houses unnecessarily expose the public to a greater risk than any benefits they may provide.

The number of days that have passed since the beginning of the New York on PAUSE (March 23, 2020).

SUMMARY: Whenever Phase 2 of the re-opening plan begins in our area in-person client appointments will be allowed in the residential real estate sector. Phase 2 of the reopening plan has NOT begun anywhere in NYS as of today. However, Phase 2 is expected soon - perhaps as soon as this weekend or early next week. NYSAR has passed along an extensive advisory for the real estate sector from New York State on what will be allowed & required during Phase 2. In person client appointments will be allowed. A more complete report along with my commentary will be posted within the next several days. As always, I am available to talk privately with you about your particular real estate situation. Call, text or FaceTime: 585-732-1767. Email: romecelli@realtor.com The number of days that have passed since the beginning of the New York on PAUSE (March 23, 2020)

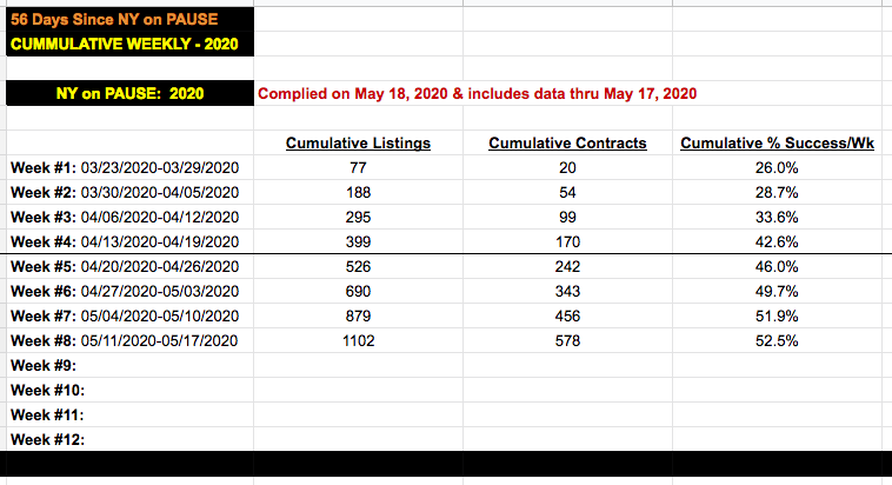

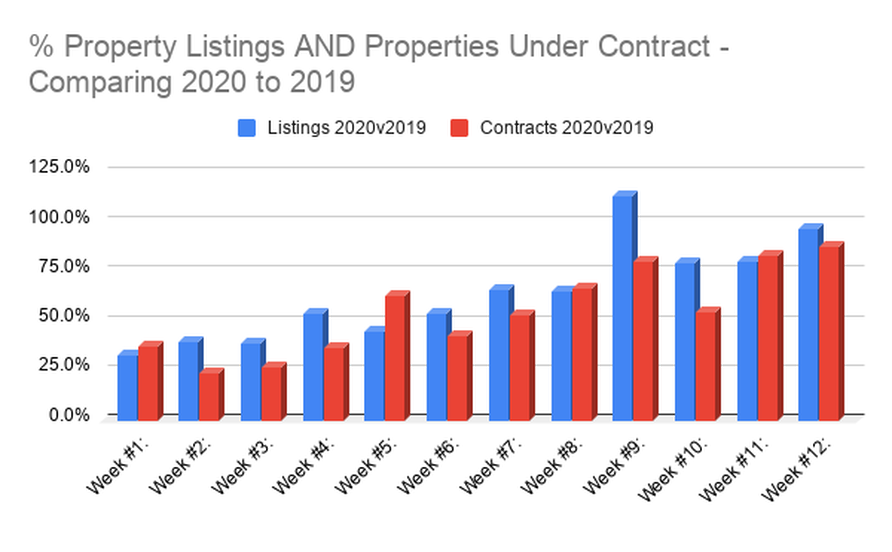

There are times when missing a deadline might be a bit of good news. What happened? I missed my self-imposed deadline for posting to this blog yesterday. Why? I was too busy with client appointments. It almost felt like a normal day in real estate. Good times! What’s really odd about my being so busy is that nothing has changed under NY on PAUSE since May 15th. Nothing. Not-one-thing. And yet the local real estate market has picked up speed. Home buyers and home sellers want to act. Real estate agents want to serve their clients. Momentum is growing.. It’s safe to engage in the real estate market but you’ll have to beware of the pitfalls and you’ll have to assert yourself. I’ll give you some guidance. As always, I am available to talk privately with you about your particular real estate situation. Call, text or FaceTime: 585-732-1767. Email: romecelli@realtor.com I host a weekly Zoom meeting to answer your general questions about the local real estate market. Mondays at 8:00 pm EST CLICK HERE TO JOIN THE MEETING Meeting ID: 585 732 1767 Password: 954010 The real estate market continues to grow slowly but the rate of increase is going up. The number of single family homes, condominiums and townhouses listed for sale last week alone jumped by over 220 last week! Yes, that's over 30 new listings per day! Compare that to the first week of the shutdown when just about 10 homes were listed each day. On the other hand, compared to last year during the same week nearly 350 properties were listed. So, although the market activity if definitely up it's still no where near where it was last year. The success rate (the percentage of properties listed that have accepted an offer) this year is coming in at about 52%. At this point In 2019 the success rate was about 60%. So, overall, the market is not quite delivering the same results this year as compared to last year. Not bad, though, right?!

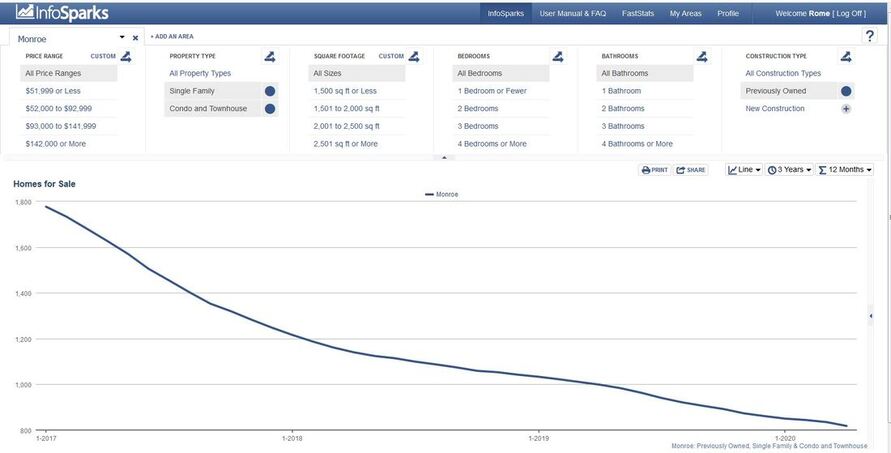

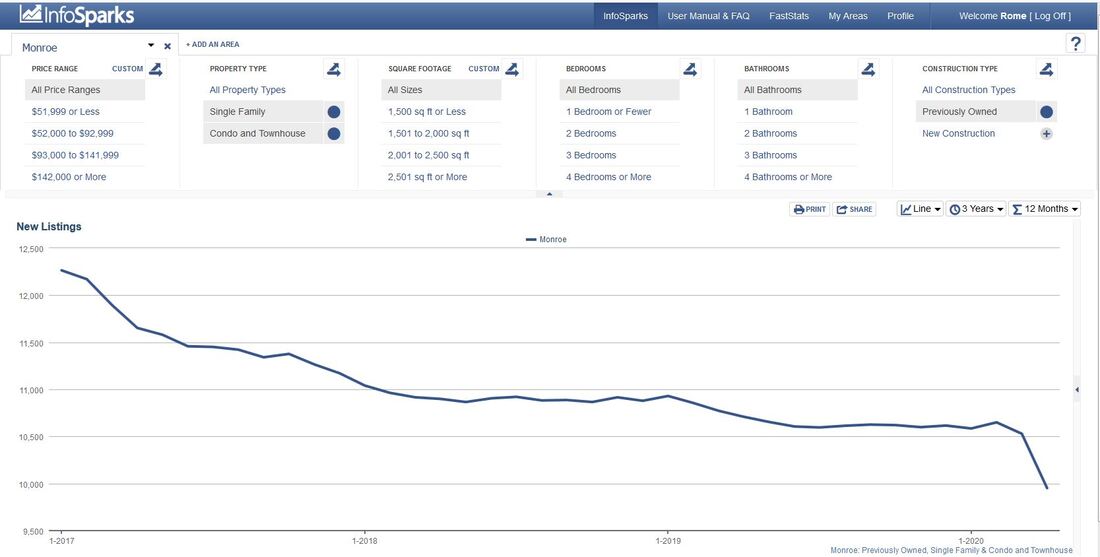

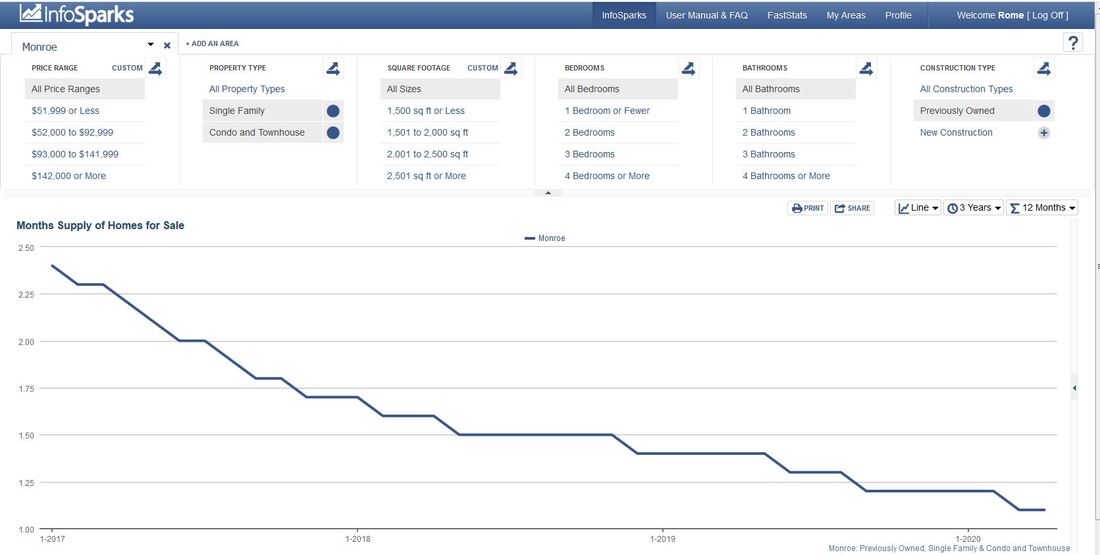

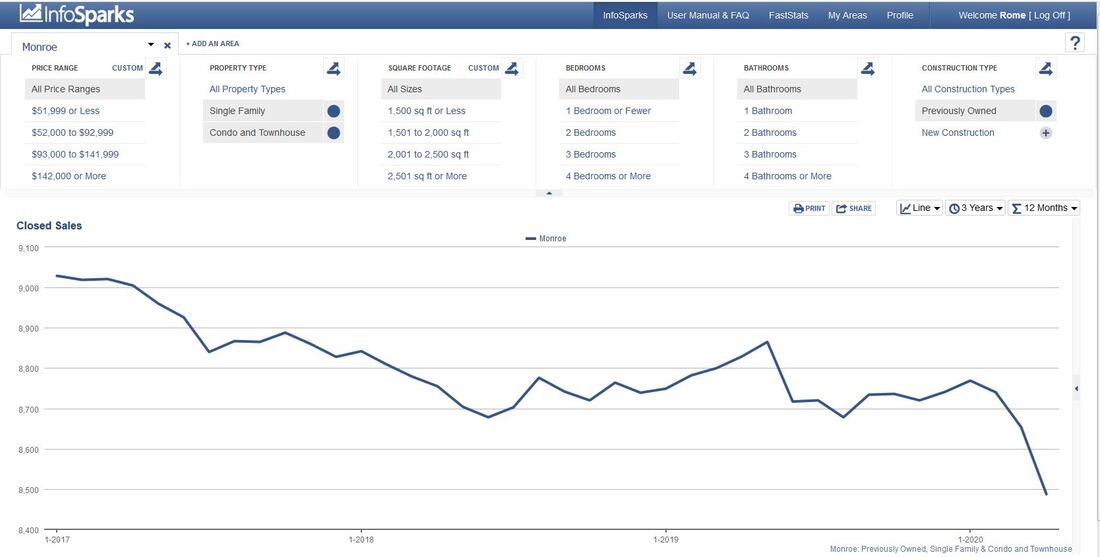

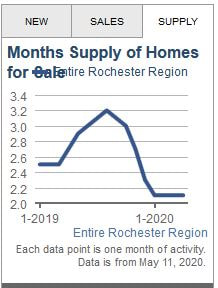

What are the immediate implications? The low inventory of properties for sale is a disincentive to buyers entering the market. You can’t buy what’s not for sale. Rising inventory is likely to draw home buyers into the market. When properties sell some of those home sellers transform into home buyers. One transaction creates another. How safe is it to engage in the real estate market? It’s safe but you’ll have to assert yourself if you want to avoid unnecessary risks. The primary risk of exposure is present when you are at properties in person. What to do? First and foremost, take all the precautions you already know about: wear a mask, wash your hands, disinfect, and, most important of all: stay away from others! There’s no reason you need to engage with others in person. None. Second, consult with me about your options. I have many ideas & techniques about how to stay safe and still maximize your results. In any case, make your concerns explicit. Don’t be afraid to push back if you are not comfortable with what you are experiencing. The information below includes single family homes, condominiums and townhouses located in Monroe County. Long term trend lines. The trend lines were obliterated by COVID-19. There are no trend lines worth projecting at the moment. Still, a look backwards can be helpful to measure the impact of COVID-19 on the local market. Months Supply of Properties Since January, 2017This graph looks at all "existing" single family homes, condominiums and townhouses listed for sale in Monroe County as of April 30, 2020. This information does not include new construction.

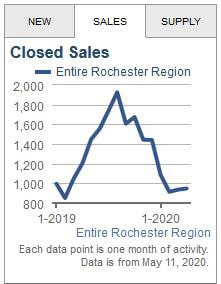

"Months of Supply of Homes For Sale" is the measure of how many months it would take for the current inventory of homes on the market to sell, given the current pace of home sales. For example, if there are 50 homes on the market and 10 homes selling each month, there is a 5 month supply of homes for sale. "Pending Sales" Since January, 2017This graph looks at all "existing" single family homes, condominiums and townhouses listed for sale in Monroe County as of April 30, 2020. This information does not include new construction.

"Pending Sales" are noted in the database after the seller has accepted a buyer's offer and the buyer's only remaining contingency is completion of the mortgage process prior to the eventual closing and transfer of title. Median Sales Price Since January, 2017This graph looks at all "existing" single family homes, condominiums and townhouses listed for sale in Monroe County as of April 30, 2020. This information does not include new construction.

The "median" is the "middle" value in the list of property sales prices. To find the median, the sales prices have to be listed in numerical order from smallest to largest. The "mode" is the value that occurs most often regardless of where it falls in the distribution. The median is very different from the mean. The mean is the average of the sales prices. It is easy to calculate. In other words it is the sum divided by the count. Our Status.

I will continue to post updates related to the metro Rochester real estate market during the coronavirus. The situation is changing rapidly. You deserve the most recent information about our real estate market from a source you trust. I wish you and your loved ones good health and good spirits during this unfortunate crisis! Yours, Rome Celli 585-732-1767 romecelli@realtor.com

The number of days that have passed since the beginning of the New York on PAUSE (March 23, 2020)

As expected, Governor Cuomo said the Finger Lakes region including Monroe County will be allowed to partially reopen its economy as of this weekend under "Phase One" of the NYS economic reopening plan with limited construction, manufacturing and curbside retail. Real estate is considered "Phase Two" of the plan. It is unclear when Phase Two will begin. In this post I'll focus attention on an update to the weekly numbers associated with the real estate market in Monroe County and compare those numbers to last year. As with prior posts I will show you the number of properties listed for sale; the number of properties under contract and the "success rate". Summary: although not much is new on the surface I noted an interesting phenomenon this week worth mentioning to you. Just below the weekly update I give you a broad overview of the real estate market in our region since 2019. This overview includes Monroe County as well as surrounding counties. In a future post I'll give you a look at the long term trends in our real estate market. Please note, I am moving my weekly Zoom meetings to a later time due to the expectation that I will be taking more appointments at locations away from my home office on most evenings for the foreseeable future. As always, I am available to talk privately with you about your particular real estate situation. Call, text or FaceTime: 585-732-1767. Email: romecelli@realtor.com I'm hosting a Zoom meeting to answer your general questions and talk about the local real estate market. PLEASE NOTE THE TIME CHANGE. I expect my appointment schedule to fill up in the evenings due to recent changes described below. As a result, I have moved my Zoom meetings later. Monday, May 11, 2020 at 8:00 pm - CLICK HERE TO JOIN THE MEETING Meeting ID: 585 732 1767 Password: 62536 Selected businesses in Monroe County & around the Finger Lakes region will re-open after May 15th. As expected, Governor Cuomo said the Finger Lakes region including Monroe County will be allowed to partially reopen its economy as of this weekend under "Phase One" of the NYS economic reopening plan with limited construction, manufacturing and curbside retail. Real estate is considered "Phase Two" of the plan. It is unclear when Phase Two will begin. Read the New York Forward Opening Guide:

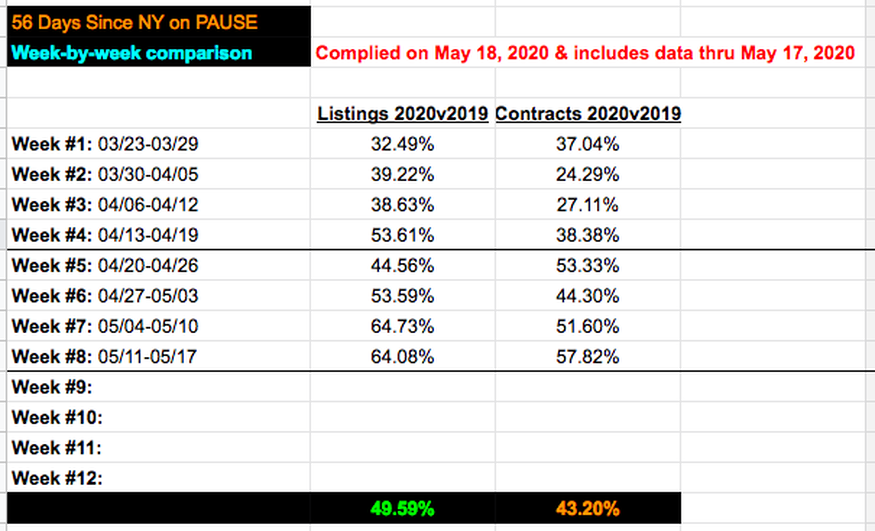

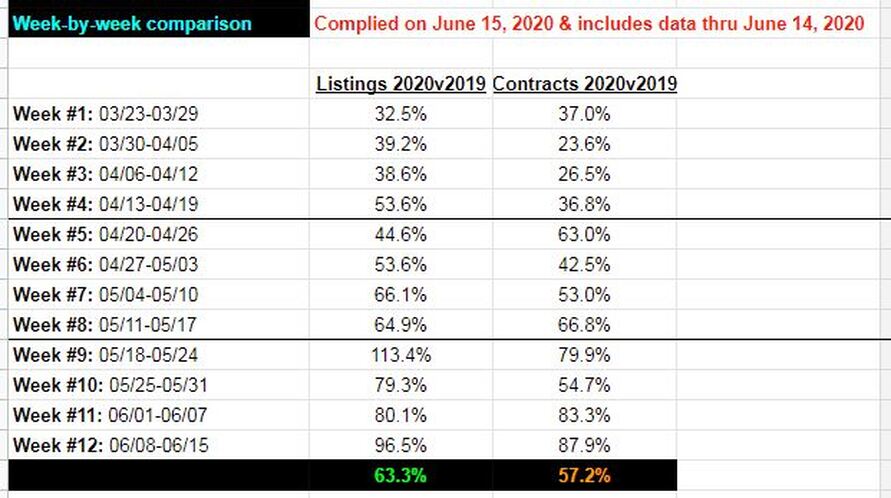

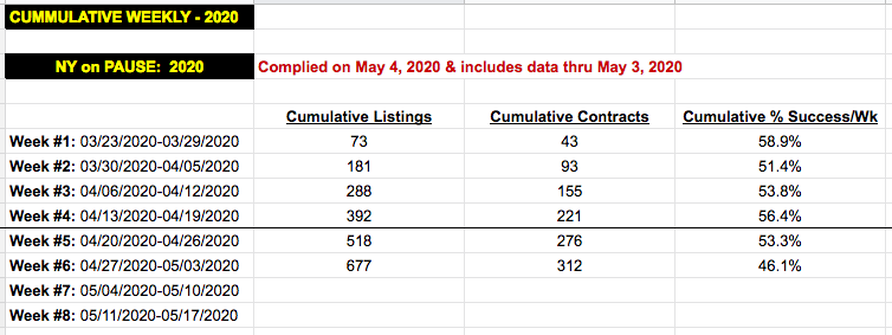

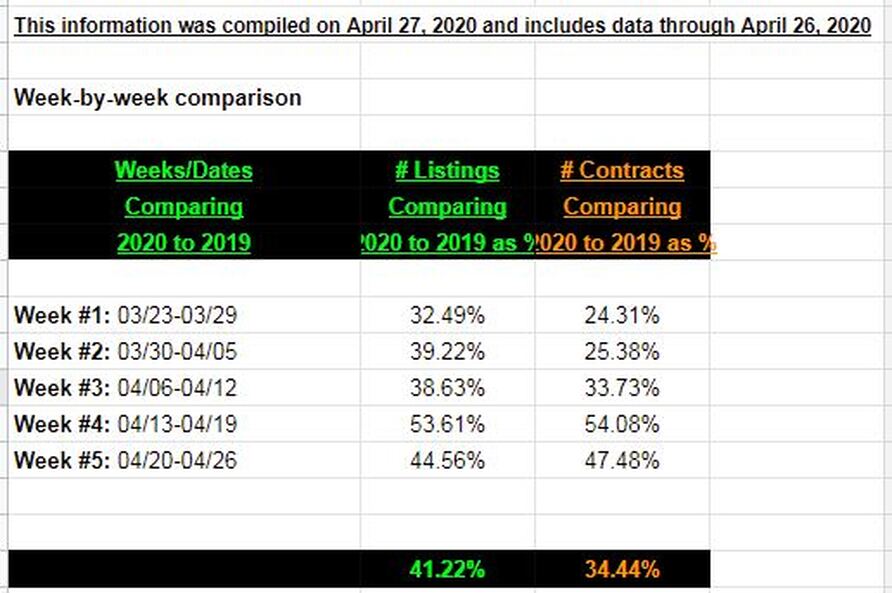

Key week-by-week real estate numbers in Monroe County for single family homes, townhouses and condominiums since March 23, 2020. One interesting tidbit that will not be apparent after a casual review of this information: The number of properties under contract (aka, the "success rate") in 2020 has been volatile. In particular, sales that occurred in the first couple of weeks after the shutdown failed not long after they were consummated. It appears sellers were accepting offers on their properties from buyers who had not actually seen the property in person. Some of those potential transactions fell apart quickly after the buyer saw the property in person. Those properties appear to have found new buyers since the overall success rate continues to rise, albeit gently, even as the overall number of listings has been rising. Sadly, the number of properties listed in 2020 is still just 46.9% as compared to the same period in 2019. The number of properties under contract is 37.4% of 2019. Gulp!

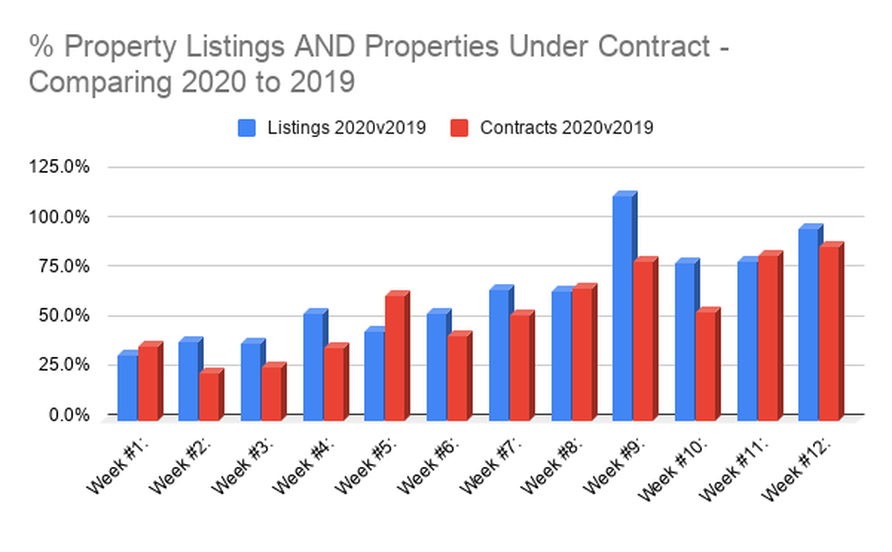

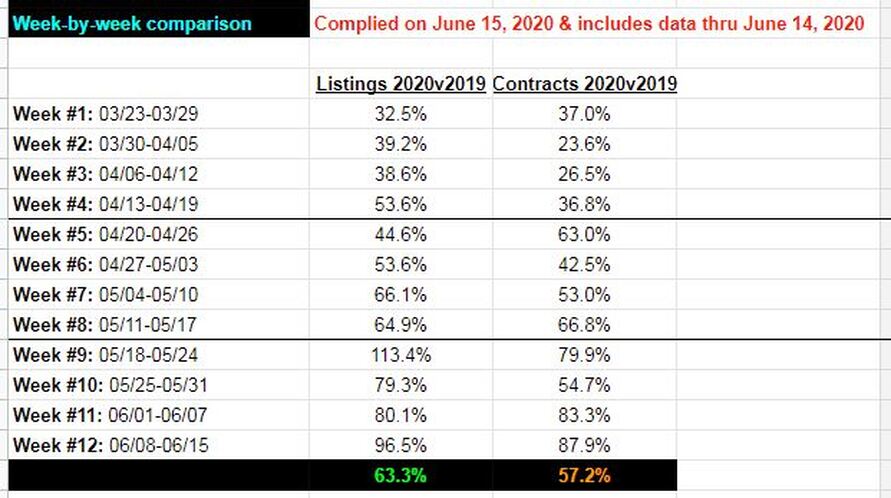

The information below includes single family homes, condominiums and townhouses located in Monroe County. This information takes the 2020 market activity and measure it against results from comparison year of 2019 directly.

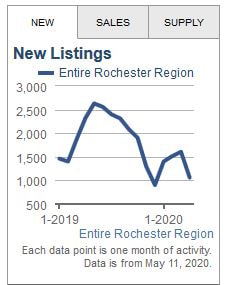

Here's a look at the regional market in our area going back to 2019. These numbers were calculated to the end of April, 2020. The first two graphs should be self-apparent. The last graph will not be familiar to most consumers: "Months of Supply of Homes For Sale" is the measure of how many months it would take for the current inventory of homes on the market to sell, given the current pace of home sales. For example, if there are 50 homes on the market and 10 homes selling each month, there is a 5 month supply of homes for sale. In my next post I'll offer a look at our marketplace going back a few years to help put the numbers we are seeing now in perspective. Our Status.

I will continue to post updates related to the metro Rochester real estate market during the coronavirus. The situation is changing rapidly. You deserve the most recent information about our real estate market from a source you trust. I wish you and your loved ones good health and good spirits during this unfortunate crisis! Yours, Rome Celli 585-732-1767 romecelli@realtor.com

The number of days that have passed since the beginning of the New York on PAUSE (March 23, 2020)

In this post I'll put most of the focus on the numbers. As usual, I'll give you my take. In addition, I'll offer some observations about what I'm seeing in the local real estate market that build on my last post. As always, I am available to talk privately with you about your particular real estate situation. Call, text or FaceTime: 585-732-1767. Email: romecelli@realtor.com I'm hosting a Zoom meeting to answer your general questions and talk about the local real estate market. Monday, May 11, 2020 at 6:30 pm - CLICK HERE TO JOIN THE MEETING Meeting ID: 585 732 1767 Password: 625369 What's notable about the numbers this time around?

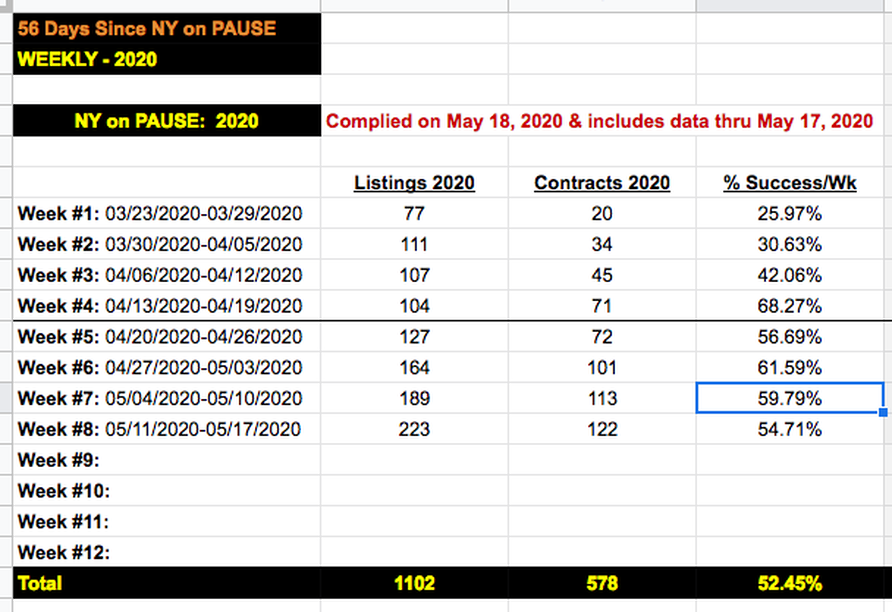

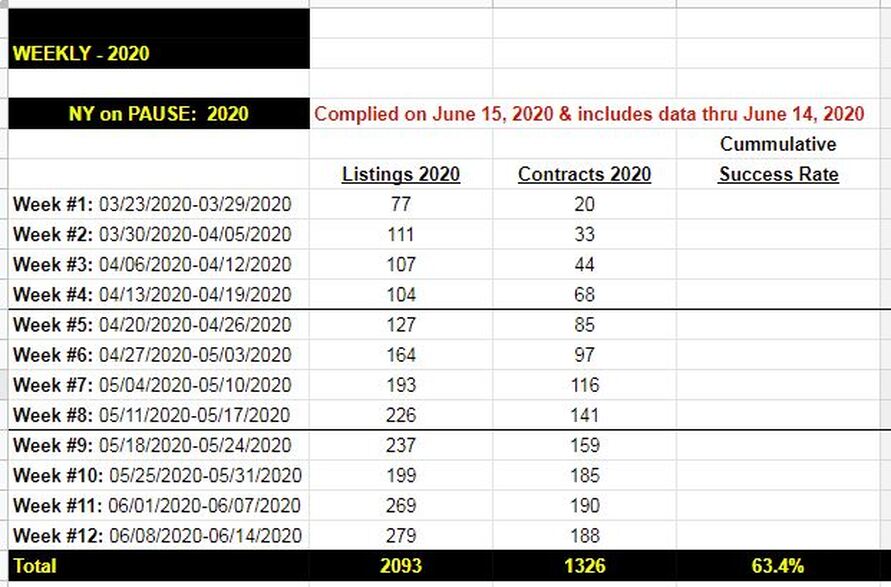

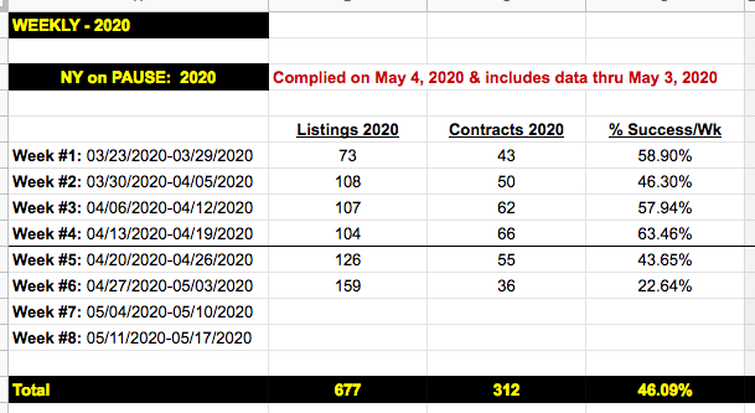

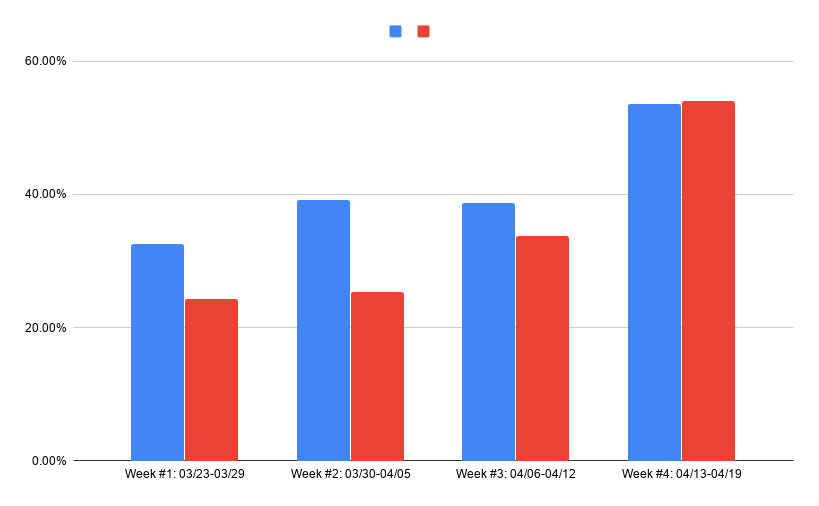

Is the risk of COVID-19 low enough to merit what the market demands? The Herd Is Speaking. As a result of the blossoming Spring real estate market pressure is mounting to push back against social distancing guidelines and the New York on PAUSE regulations. Home buyers, who tend to be younger and less vulnerable to COVID-19, are becoming intent on doing whatever they need to do get an advantage over other buyers; seeking to reduce their home buying risk by looking at properties in person; and maximizing efficiency over personal and societal safety. A herd mentality fed by self-interest, cabin fever, nice weather is eroding support for caution. Sellers, who up to this point have been far more concerned than buyers about the immediate impacts of exposure to coronavirus, are beginning to turn in favor of seeking higher prices and better terms over maintaining safer practices. Groups of buyers are filing through properties in some areas creating a breeding ground for coronavirus exposure. "Unaccompanied" solo appointments are transforming into turnstiles appointment schedules. It doesn't help that the New York on PAUSE executive order is filled with admonitions & exhortations rather than explicit enforceable prohibitions. People are behaving badly behind a fig leaf: wearing a cloth mask & gloves. It reminded one of my colleagues who said on a recent call it seems like when you take antibiotic for three days and your fever's down to normal. You feel great. So, you decide you don't need to finish the remaining seven days of your prescription. If what I have been seeing continues, the real estate market in our area is going to blow New York on PAUSE wide open let the consequences be damned. We'll see... Key week-by-week real estate numbers in Monroe County for single family homes, townhouses and condominiums: The number of properties listed for sale and the number of properties under contract in 2020 calculated on a weekly basis since March 23, 2020.The third column in this chart shows the week-by week "success rate" (the percentage of properties listed in a given week that have taken a contract) in 2020.

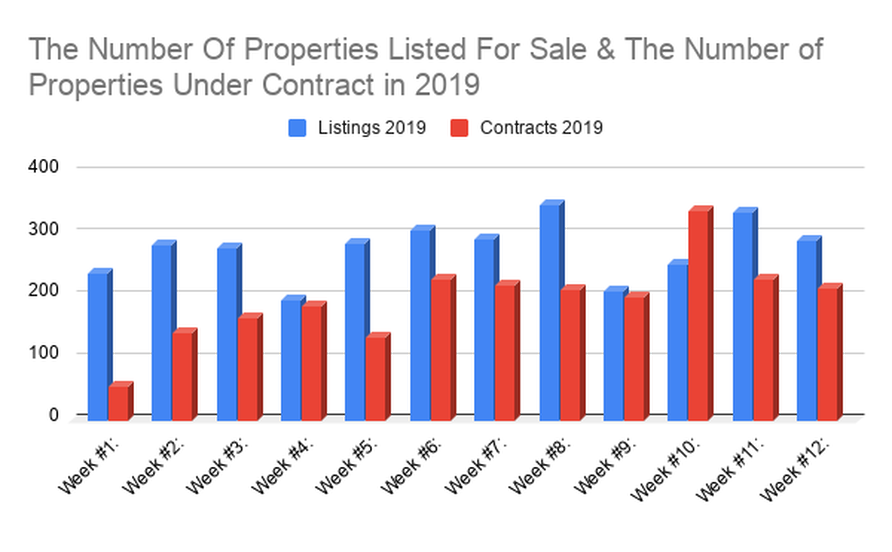

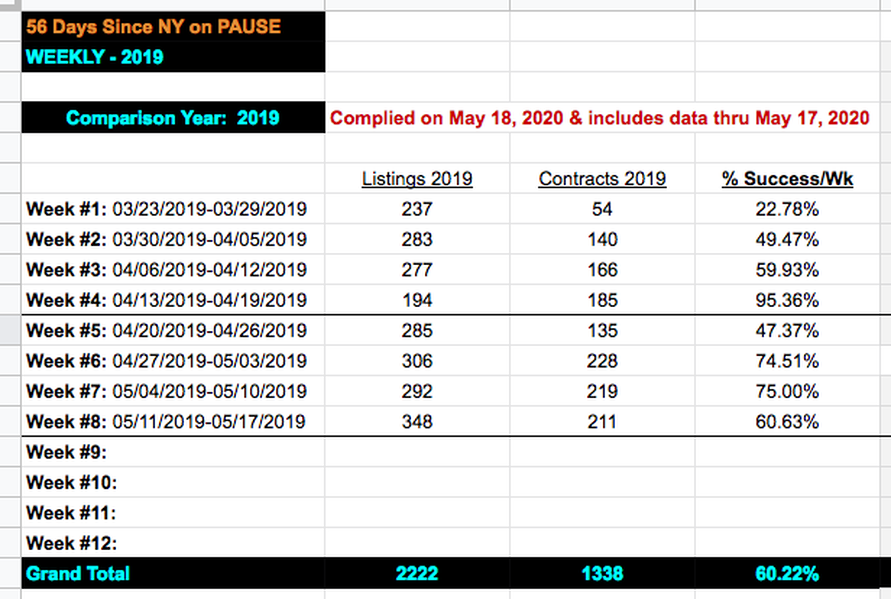

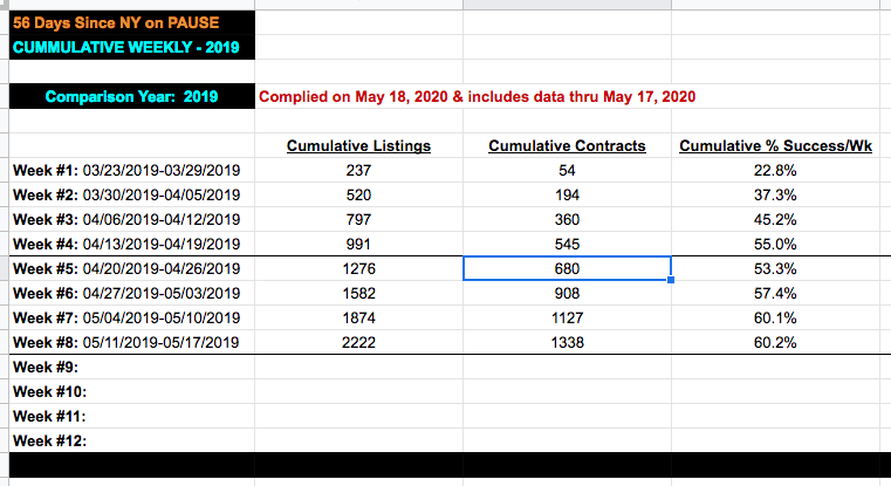

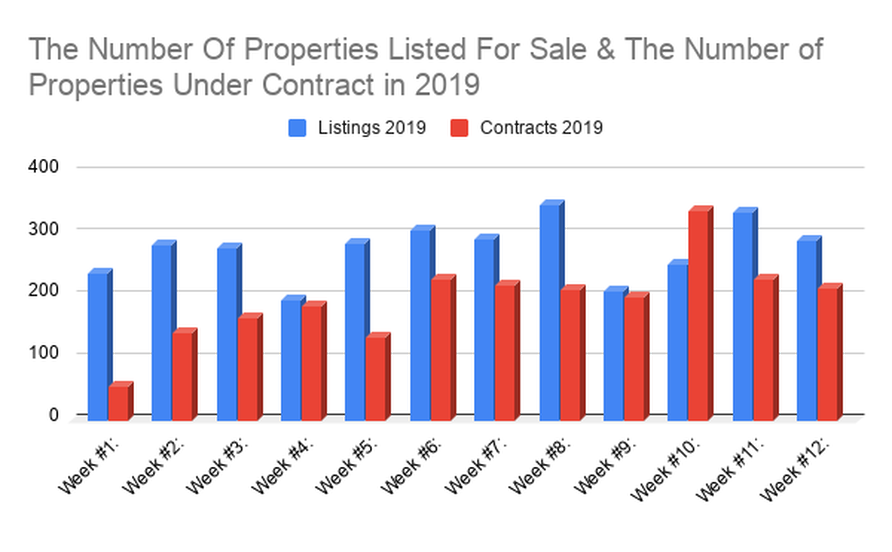

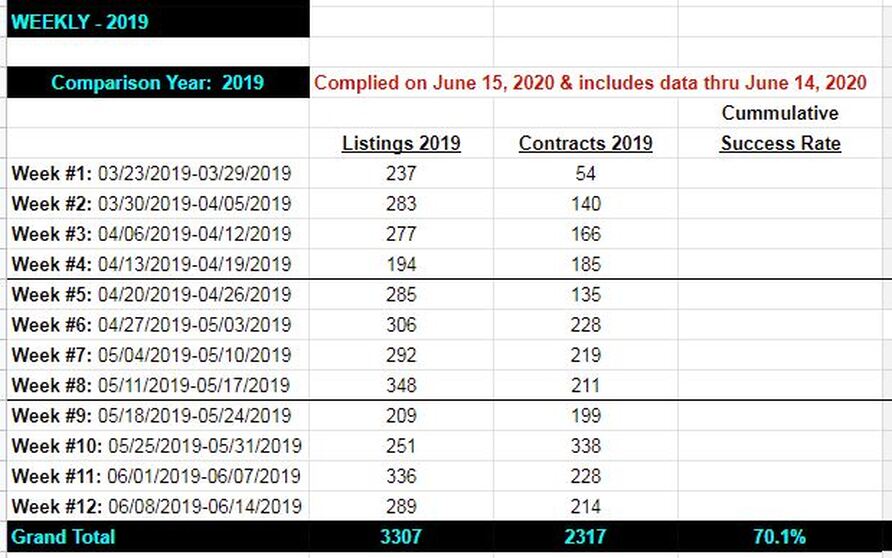

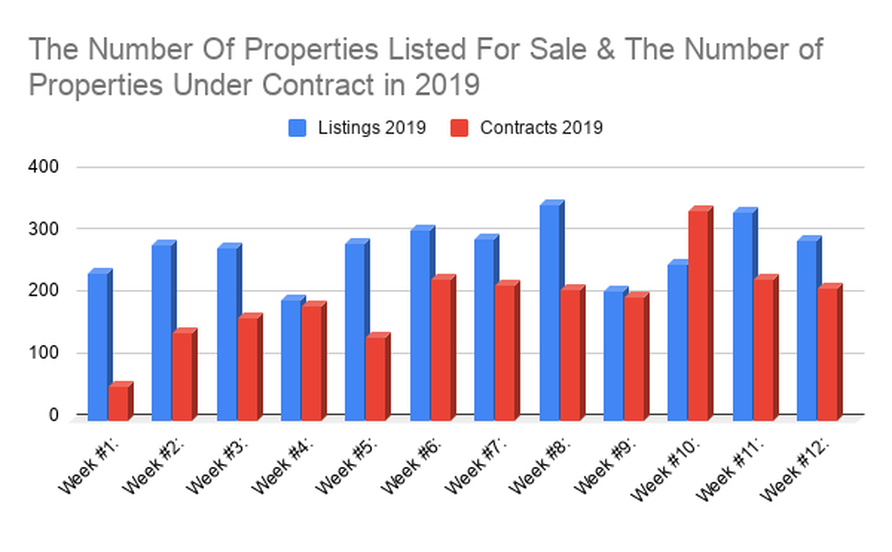

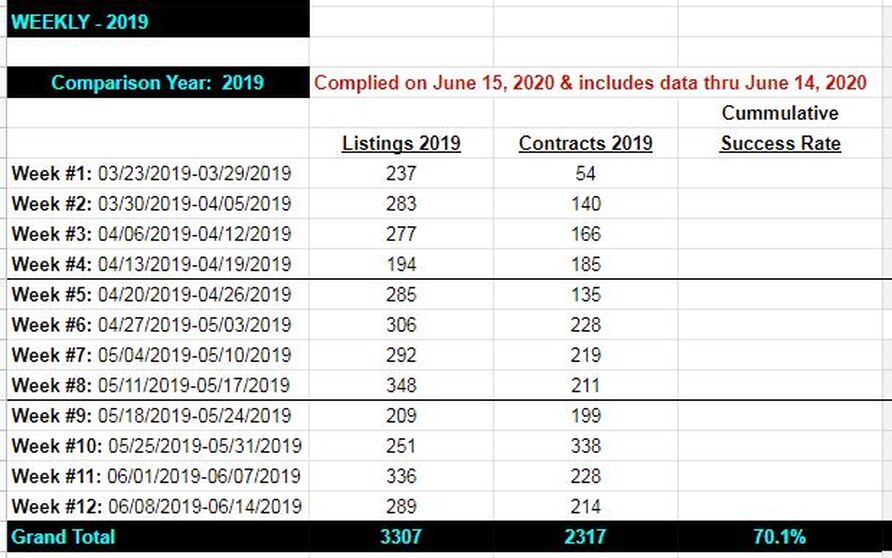

The number of properties listed for sale and the number of properties under contract in 2019 calculated on a weekly basis since March 23, 2019.The third column in this chart shows the week-by week "success rate" (the percentage of properties listed in a given week that have taken a contract) in 2019.

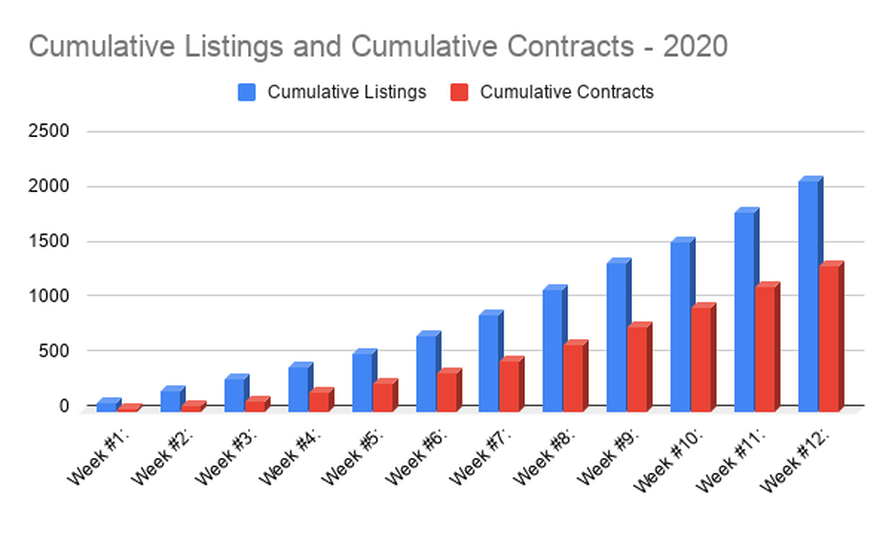

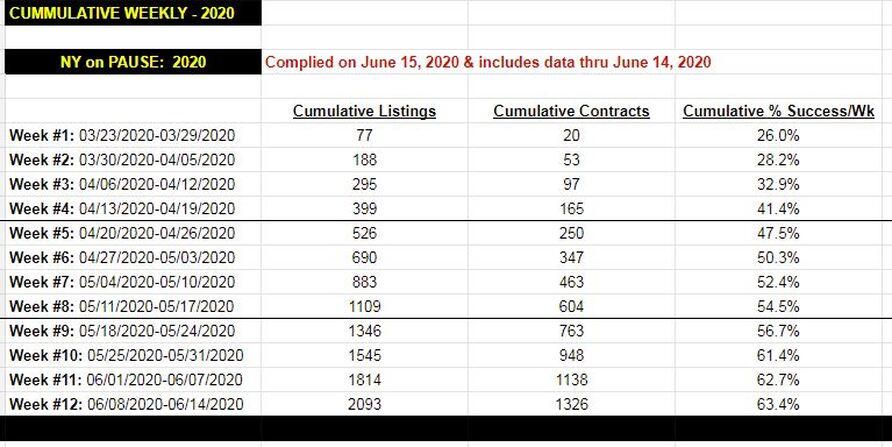

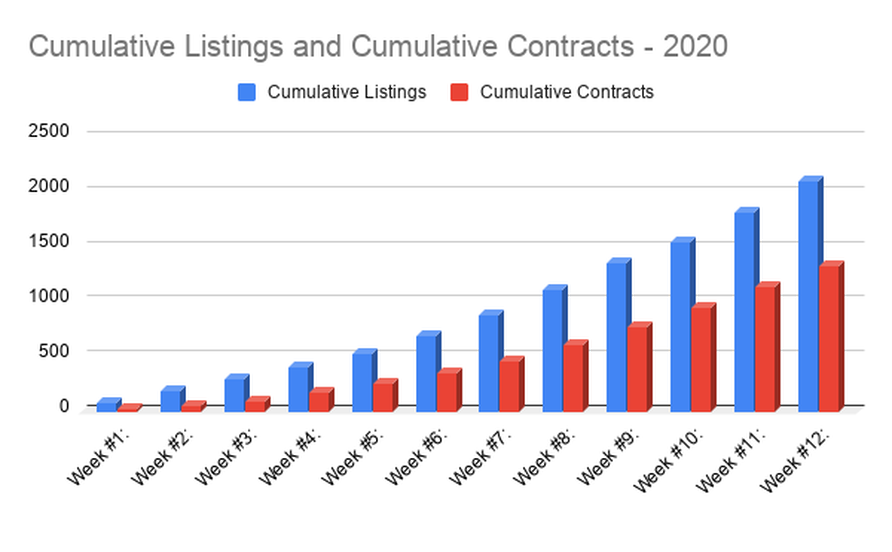

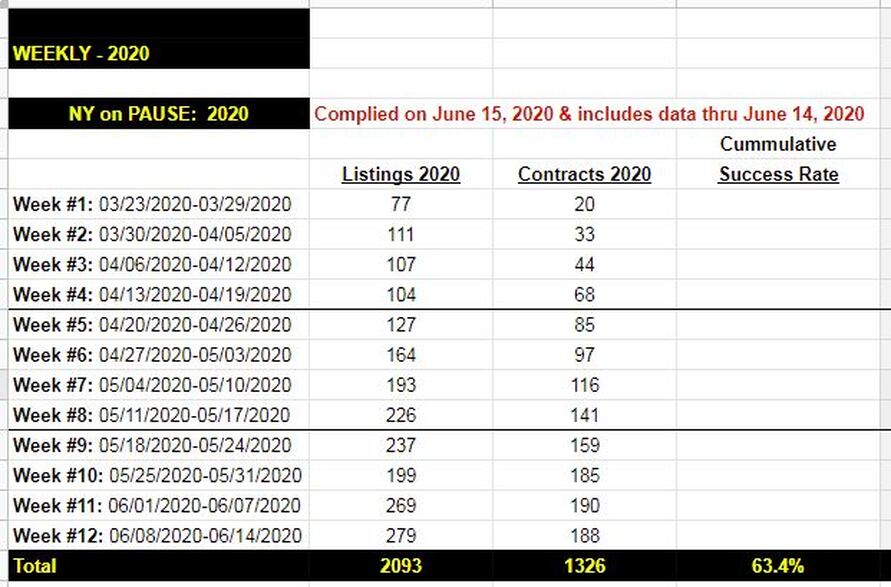

The cumulative number of properties listed for sale and the cumulative number of properties under contract in 2020calculated on a weekly basis since March 23, 2020.The third column in this chart shows the cumulative week-by week "success rate" (the percentage of properties listed in a given week that have taken a contract) in 2020.

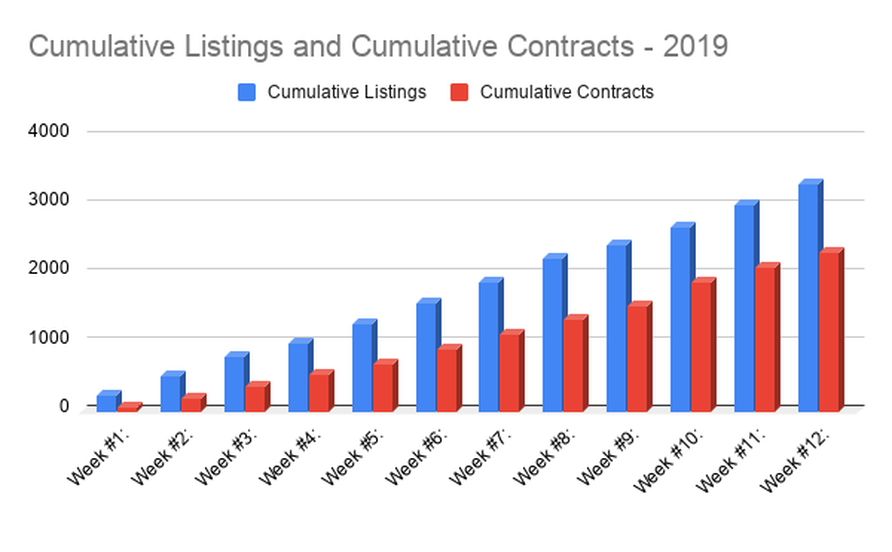

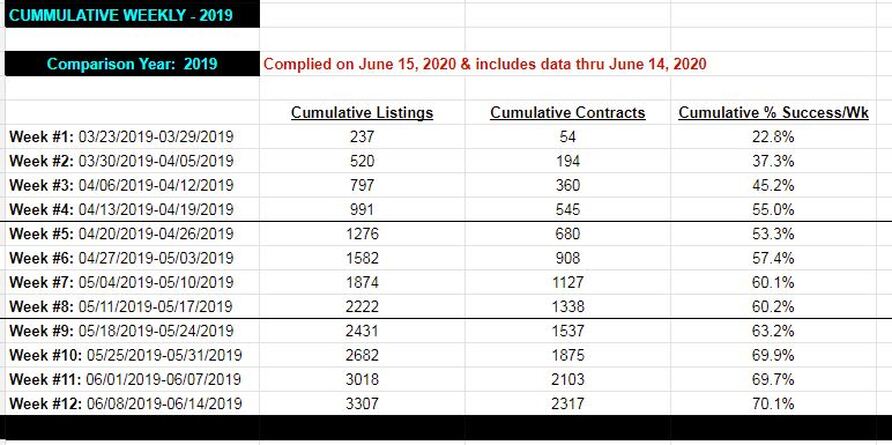

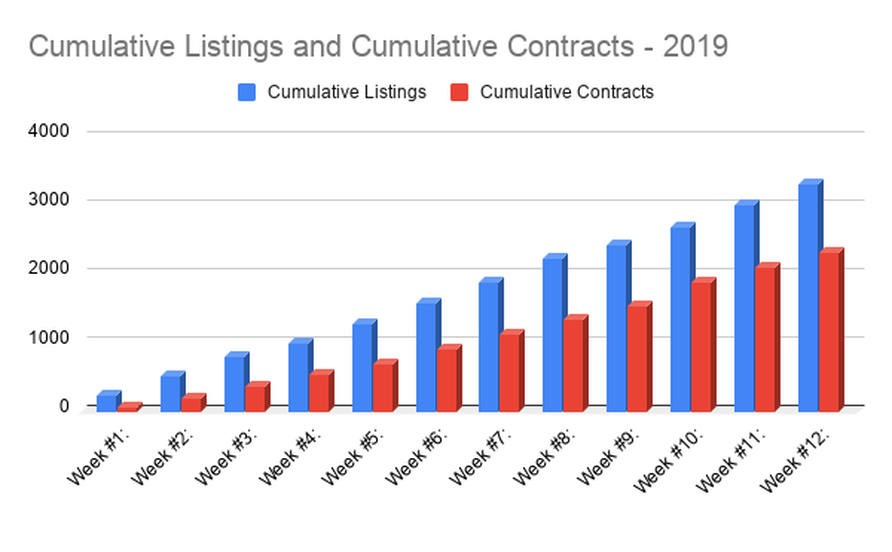

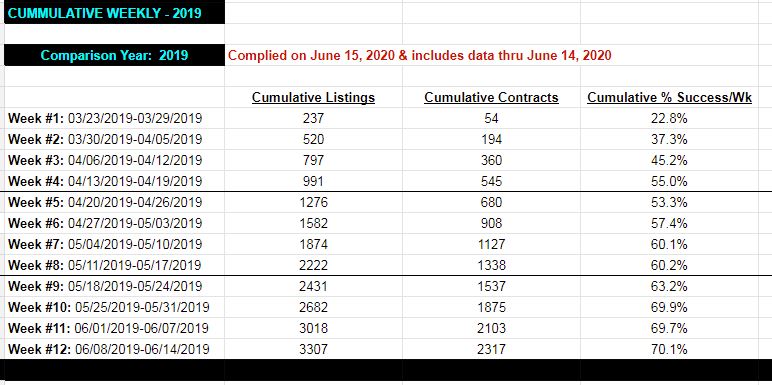

The cumulative number of properties listed for sale and the cumulative number of properties under contract in 2019calculated on a weekly basis since March 23, 2019.The third column in this chart shows the cumulative week-by week "success rate" (the percentage of properties listed in a given week that have taken a contract) in 2019.

Key cumulative numbers in Monroe County for single family homes, townhouses and condominiums: The real estate market in 2020 under the New York on PAUSE restrictions:

The real estate market in 2019:

Our Status.

I will continue to post updates related to the metro Rochester real estate market during the coronavirus. The situation is changing rapidly. You deserve the most recent information about our real estate market from a source you trust. I wish you and your loved ones good health and good spirits during this unfortunate crisis! Yours, Rome Celli 585-732-1767 romecelli@realtor.com

The number of days that have passed since the beginning of the New York on PAUSE (March 23, 2020)

Now that more than a month has passed I was able to compile some numbers for a week-by-week comparison rather than looking exclusively at the every-other-day cumulative data I've been sharing up to now. There's a LOT of information to take in. I don't want to overload you. So, here's the exec summary: The local real estate market isn't all doom and gloom even under these very difficult circumstances. The trend lines look promising even if the overall number of listings and transactions are way down compared to last year. All the nitty and the gritty numbers are below.

The virus numbers continue to trend downwards. Governor Cuomo has been devoting more time to his plans for reopening the economy in New York State. Yesterday he indicated the state would likely open up construction and manufacturing businesses around May 15th. In my opinion the first step in reopening the real estate market will not be far behind. Remember, I said the first step would be that real estate agents would be allowed to enter properties ALONE regardless of whether or not the property is vacant. That day is coming and it's coming soon. As always, I am available to talk privately with you about your particular real estate situation. Call, text or FaceTime: 585-732-1767. Email: romecelli@realtor.com

I'm hosting a Zoom meeting to answer your general questions and talk about the local real estate market.

Monday, April 27, 2020 at 6:30 pm - CLICK HERE TO JOIN THE MEETING Meeting ID: 585 732 1767 Password: 625369 Real estate market data: A week-by-week comparison to last year.

First, a primer on the information you see below. Now that we are more than a month out from the shutdown date of March 23, 2020 we have enough data to compare a series of weeks. There is a natural weekly rhythm to real estate. Each week the cycle tends to repeat. I wanted to see if any interesting trends were emerging that could only be discerned by looking at weekly numbers.

Key real estate numbers in Monroe County for single family homes, townhouses and condominiums:

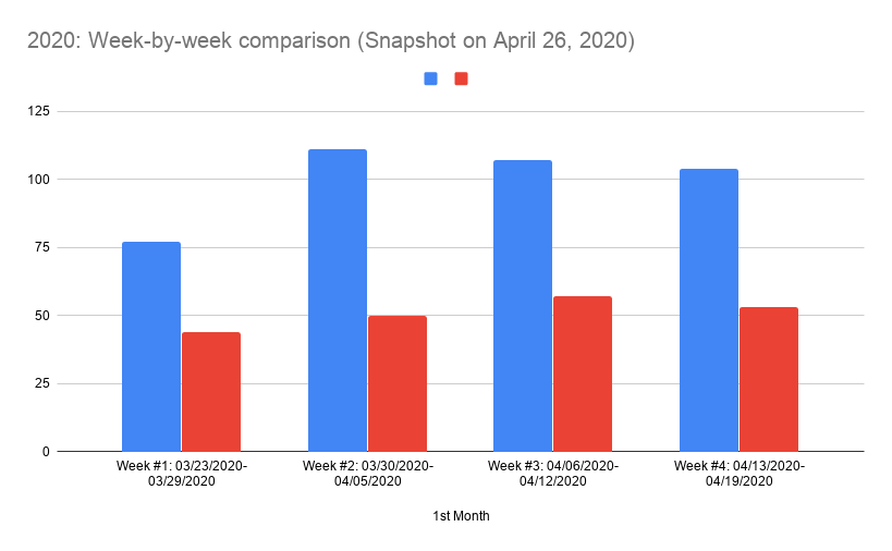

Looking at the current year under NY on PAUSE:

# Listings: Shows the number of new property listings that were registered in a given week. # Contracts: Shows the number of homes on the market that have an accepted offer (as of April 26, 2020). This column is a bit tricky to understand because a property listed in the first week might receive an offer at any time thereafter. So, the number of listings each week remains constant while the number of purchase contracts changes frequently. To make matters more complicated the number of contracts may go up and down. Why? Because some offers fall apart. As time passes, however, we would expect the "success rate" to rise as more and more properties take offers and those offers eventually close. So, to get an accurate picture of market activity you have to update the information over time.

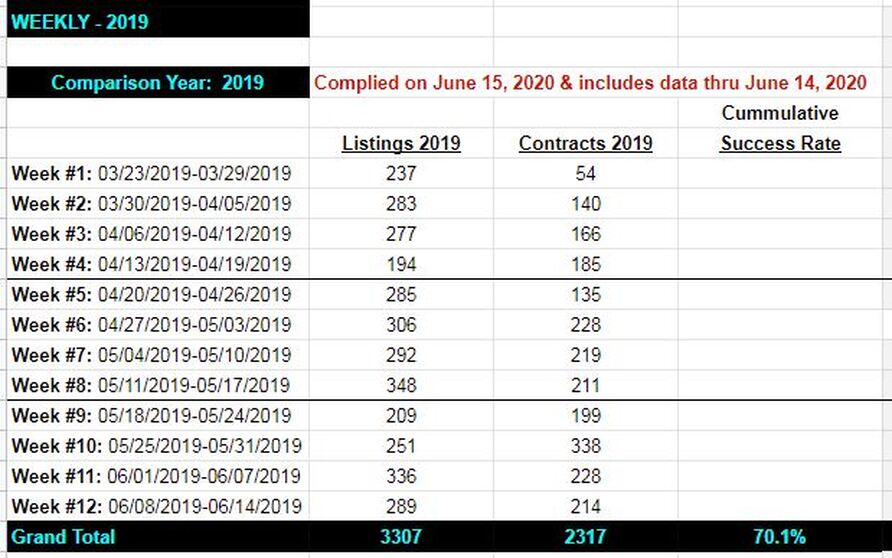

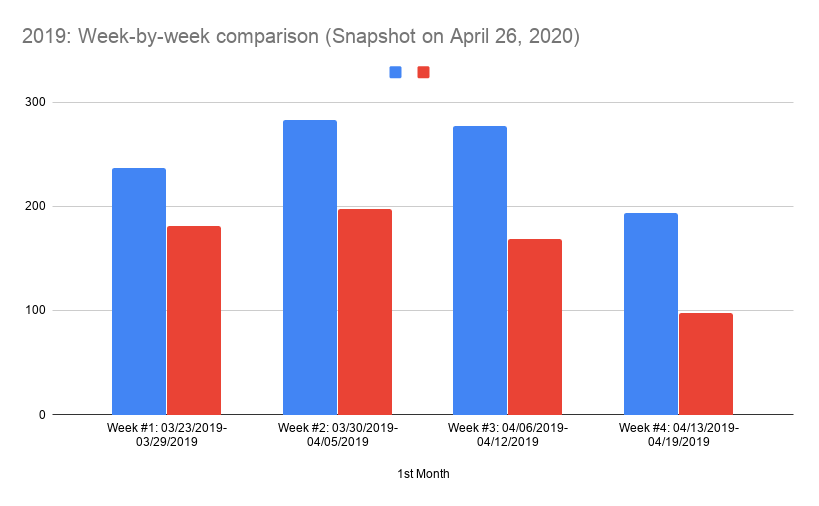

Looking back to our comparison year of 2019: Where we at this time last year?

# Listings: Shows the number of property listings that were registered in a given week back in 2019. # Contracts: Shows the number of homes on the market back in 2019 that took an offer. Although this data set looks back a full year it is still a snapshot of the market taken on April 26, 2019. So, properties listed on April 17th may not have accepted an offer as of April 26th. # Listings Comparing 2020 to 2019 as a percentage: This column compares 2020 to 2019 directly by dividing the number of new property listings in a given week in 2020 by the number of new property listings in a given week in 2019 to obtain a percentage. # Contracts Comparing 2020 to 2019 as a percentage: This column compares 2020 to 2019 directly by dividing the number of accepted offers in 2020 (as of April 26, 2020) by the number of accepted offers in 2019 (as of April 26, 2019) to obtain a percentage.

What do the week-by-week data tell us?!

First, and perhaps most importantly, the success rate between this year and last year is down BUT it's not down dramatically and it appears to be getting stronger. Actually, the success rate is better than one would have expected under these circumstances. As a result, it does not appear as though property values are suffering at this stage of the crisis. That is NOT to say property values are rising. In fact, values may still take a hit. We won't know for sure for many months. Still, the fact that a good percentage of properties are accepting offers is a encouraging sign indeed. Second, it appears newer listings are getting more action than older listings. My guess is that buyers entering the market every day are focusing on new listings. "Older" listings (those on the market a week or longer) aren't as highly regarded by buyers as the brand new property listings that pop up moment by moment. Lastly, the overall number of listings and accepted offers are still way, way down compared to last year. I doubt we'll ever catch up to the overall number of transactions.

All of the week-by-week information described above has been embedded in the reports I've been sending up to now. The big difference is the data below offers a cumulative perspective rather than exposing week-by-week trends.

The real estate market in 2020 under the New York on PAUSE restrictions:

The real estate market in 2019:

Cuomo explains his plan to reopen the economy regionally in NYS:

Our Status.

I will continue to post updates related to the metro Rochester real estate market during the coronavirus. The situation is changing rapidly. You deserve the most recent information about our real estate market from a source you trust. I wish you and your loved ones good health and good spirits during this unfortunate crisis! Yours, Rome Celli 585-732-1767 romecelli@realtor.com

RSS Feed RSS Feed

The number of days that have passed since the beginning of the New York on PAUSE (March 23, 2020)

Thirty days have passed since the start of Governor Cuomo’s executive order known as “New York on PAUSE”. It appears the COVID-19 infection curve is flattening in our area. We still have difficult and painful COVID-19 news on the horizon but, thankfully, we appear to be heading towards better days. Real estate property listings and sales are inching up s-l-o-w-l-y. The growth in newly listed properties is picking up steam. The “success rate” is up, too. Overall, however, compared to the same period last year, the numbers are still anemic. Updated numbers are below. As always, I am available to talk privately with you about your particular real estate situation. Call, text or FaceTime: 585-732-1767. Email: romecelli@realtor.com I'm hosting a Zoom meeting to answer your general questions and talk about the local real estate market. Monday, April 27, 2020 at 6:30 pm - CLICK HERE TO JOIN THE MEETING Meeting ID: 585 732 1767 Password: 625369 Key real estate numbers in Monroe County for single family homes, townhouses and condominiums: The real estate market in 2020 under the New York on PAUSE restrictions:

The real estate market in 2019:

A growth trend in the real estate market may be emerging. Some days the number of newly listed properties drifts down but recently the numbers seem to be trending up. The same is true for the number of properties with an accepted offer AND the success rate - the percentage of properties that have offers. Yes, the absolute number of property listings in 2020 and the number of properties under contract in 2020 remains very, very low compared to last year. No, real estate agents still can’t leave their homes except in certain very limited circumstances. If the numbers continue to rise, it will indicate:

Still, we have a long, long way to go... Looking into my crystal ball: Here are my current PREDICTIONS as to when/how the real estate market will be reopened in the coming months. Of course, I could be wrong. Every businessperson plans using predictions. I’ve been doing so for decades. These are the dates and activities I am planning around at the moment:

UNLESS, of course, something goes wrong... Our Status.

I will continue to post updates related to the metro Rochester real estate market during the coronavirus. The situation is changing rapidly. You deserve the most recent information about our real estate market from a source you trust. I wish you and your loved ones good health and good spirits during this unfortunate crisis! Yours, Rome Celli 585-732-1767 romecelli@realtor.com

The number of days that have passed since the beginning of the New York on PAUSE (March 23, 2020)

My last post prompted a number of questions & then conversations with individual clients around interpretations of the rules related to the real estate market under New York on PAUSE. You, too, may be wondering how I would handle your particular situation. I layout my approach below. The newest numbers show a rise in the "success rate" - the number of properties that have taken an offer as a percentage of the number of properties listed for sale since March 23, 2020. The number of properties listed for sale dropped a bit compared to the last report. All the details are below. Just a few days ago I read a blog post by a reliable source with some important advice about mortgage payment forbearance during the pandemic. I'll give you a quick summary of the letter along with a link to the full details. If you are willing to spend 15-30 minutes reading an analysis of actions necessary to halt COVID-19 and then reopen the economy, I strongly recommend you check the information and links below. As always, I am available to talk privately with you about your particular real estate situation. Call, text or FaceTime: 585-732-1767. Email: romecelli@realtor.com I'm hosting a Zoom meeting to answer your general questions and talk about the local real estate market. Monday, April 20, 2020 at 7:00 pm - CLICK HERE TO JOIN THE MEETING Meeting ID: 585 732 1767 Password: 625369 My real estate services under NY on PAUSE explained. My last post on the ways NY on PAUSE was being interpreted left some clients with questions. They contacted me asking what the various interpretations meant for their particular situation as well as a for a clarification about how I will conduct my business. Here's the answer in a nutshell: "informed service customization." Now as ever I will take a consultative approach. First, I will listen.

Then we will discuss the NY on PAUSE rules and the various interpretations I'm seeing out the marketplace. We will review the advantages and disadvantages of each option along with all the other considerations necessary for you to make informed choices. In the end you will decide what's best. I will implement your plan as you direct. Bottom line: The real estate services I provide to you will be customized to suit your particular interests; maximize the benefits to you and minimize any foreseeable downside risks. I have learned it's best to make a plan, implement the plan, remain flexible, consider the results along the way, and adjust as necessary until you reach your goals. Key real estate numbers in Monroe County for single family homes, townhouses and condominiums: The real estate market in 2020 under the New York on PAUSE restrictions:

The real estate market in 2019:

My observations on these updated numbers. The number of property listings in 2020 and the number of properties under contract in 2020 remains very, very low compared to last year.

If the success rate continues to rise over time and becomes a trend, it will indicate:

It's still far too early to know which way the numbers will trend. For example, if the number of properties listed for sale rises faster than the number or properties taking offers in the coming days, that would put a damper on any advantages for sellers. We have a long, long way to go... Some advice about "mortgage forbearance": A couple of days ago a very reliable source, Mike Donoghue (founder, President and CEO of Premium Mortgage Corporation), posted an important alert regarding mortgage payment forbearance on the Premium Mortgage website blog. Donoghue points out mortgage forbearance isn't NOT mortgage forgiveness. He points out to readers who may want to take advantage of new mortgage forbearance rules there are some significant unfortunate side effects related to borrowers' future creditworthiness. Anyone experiencing cash flow problems may want to look at other options before signing up for mortgage forbearance. CLICK HERE to read Mike Donoghue's blog post. If you only have time to read one analysis related to stopping COVID-19 and reopening the economy, read on... Over the past few weeks I have been following and reading posts by Tomas Pueyo on Medium.com. The site is free. His posts have proven insightful and predictive. If you have time, go back and read his posts from March 1st up to now. Pueyo will post his analysis of how to re-open up the economy on a serial basis, once each day. Click here to read his most recent post. Our Status.

I will continue to post updates related to the metro Rochester real estate market during the coronavirus. The situation is changing rapidly. You deserve the most recent information about our real estate market from a source you trust. I wish you and your loved ones good health and good spirits during this unfortunate crisis! Yours, Rome Celli 585-732-1767 romecelli@realtor.com

The number of days that have passed since the beginning of the New York on PAUSE (March 23, 2020)

In my last post I asked you to weigh in on the impact of the pandemic on the local real estate market. Your answers and my notes are below. There are rules and then there are interpretations of rules. Ask three real estate agents about how the “NY on PAUSE” rules apply under a given set of circumstances and you will probably get three difference answers. Even the local and state real estate trade associations don’t appear to agree. How does this affect the our real estate market? Should differing opinions about the rules change your decisions? See below. The number of new property listings continues to rise but the number of accepted contracts remain low. I’ve added a new calculation: “Success Rate”. I’ll give you the numbers and explain Success Rate below. As always, I am available to talk privately with you about your particular real estate situation. Call, text or FaceTime: 585-732-1767. Email: romecelli@realtor.com I'm hosting a Zoom meeting to answer your general questions and talk about the local real estate market. Monday, April 20, 2020 at 7:00 pm - CLICK HERE TO JOIN THE MEETING Meeting ID: 585 732 1767 Password: 625369 Survey Responses: 39 responses out of 97 (40% response rate) Question #1: Roughly, when do you think real estate agents will once again be able to meet their clients in person (even if social distancing is still required)? Summer, 2020 - 30 - 77% Fall, 2020 - 6 - 15% Spring, 2020 - 3 - 8% Winter, 2020-2021 - 0 - 0% A few notable comments sent by clients: “...my optimistic hope is that we'll be back to some amount of normalcy for small groups by the end of June.” — “Based on what we're seeing in local Covid cases and what the county health commissioner is saying, we think the county might advise lifting local restrictions in mid to late June. If that's the case, presumably agents could start seeing clients in July.. If local cases start rising sharply, obviously that date would move to fall – or later.” — “This will depend on availability of tests for immunity.” My take: I agree with the majority view on this one. Unless the rate of infection begins to rise again real estate agents are likely to be able to meet clients in person (small groups only) sometime this summer. If I had to guess when? Late June or early July. Question #2: Are real estate transactions too much of a health risk for society right now? No - 28 - 72% I don’t know - 7 - 18% Yes - 4 - 11% A few notable comments sent by clients: “With strict social distancing protocols I think it should be allowed. People can feel free to opt out or use video if they prefer that.” — “There are ways to protect those involved, if diligent.” — “i beleive remote real estate transactions are no problem, but meeting in person still carries a huge risk” — “If practiced with all proper caution, they are less risky than grocery shopping.” — “We know the proper procedure. How long can we live in a bubble?“ — “I am 'post 65' and have a history of chronic pneumonia, I am concerned. I am also a client who was to list my home the first week of April ... I, hopefully, am planning to sell my house some time this year, when is really out of our hands and in the hands of the virus and societies ability to deal with it. I do feel this will not extend to the creation of a vaccine, more likely a development of a therapeutic that allows this illness to be less lethal. Then we have more or less a severe flu event.” My take: Again, I agree with the majority view. Frankly, as long as real estate professionals conduct their business remotely/responsibly and encourage their clients and the public to do so as well, I do not think the real estate transactions under the current rules present a significant risk to individual or public health. Question #3: Overall, what will happen to property values in Monroe County in 2020? Down - 22 - 56% Same - 17 - 44% Up - 0 - 0% A few notable comments sent by clients: “I would imagine there is going to be higher demand for rental properties as investors worry about recession and a possible depression of our economy, lasting many months or perhaps 1-2 years.” — “on average i expect properties to stay about the same, but this heavily depends on hopw long this pandemic and PAUSE rules stay in place, as well as how many people stay employed” — “Pure hunch here; unless unemployment AMONG HOMEBUYERS rises, or Covid lasts a long time here or returns in the fall, etc., I think the real estate market will settle down.” — “I think they will go down temporarily as people recover from their losses. I feel it will rebound in the spring of 2021 if we can keep this virus at bay. With a little luck we may see a resurgence in the early Fall.” My take: This is a tough one. First, here’s what I would bet on: the overall number of transactions year-over-year will be down by a greater amount than I’ve seen in the 40 years I’ve been practicing. I don’t see how we can catch up to the shear volume of last year’s transactions. I’m not sure a lower number of transactions necessarily results in lower property values. Lower values will result from too many houses for sale compared to the number of buyers. Clearly, if you loose your job, you probably can’t buy a home. Losing your job doesn’t necessitate selling a home though - at least not right away. We saw this in 2008-2010. Remember, not every house that’s listed MUST sell. Some will try and if they aren’t successful, owners may just pull their property off the market and wait. Only properties that actually sell are counted towards the property value calculation. I suspect we are in for a modest recession lasting one to two years or so. A modest recession will probably balance the market between buyers and sellers in rochester giving buyers more leverage then they’ve had in a number of years and that will tend to reduce the rate of growth in values if not cause values to actually decline. Interest rates will probably drop so that should help keep the market rolling. Even so, many buyers will tend to step down to somewhat lower priced homes dragging the median price in that direction. Sellers may have to work harder to get their property ready for the market. Average homes in Rochester will linger on the market a little longer than they have in recent memory. If we dip into recession I’m willing to bet there will still be pockets in our area that will continue to do very well. Properties that may have attracted many offers may only get several. Instead of selling right off the bat it may take some properties a bit longer. Nothing about a modest recession will change the underlying market appeal found in those hot areas. On the other hand, if we enter a major/protracted economic recession or a depression, property values will come down. The same is likely to be true if we experience a second wave of COVID-19 in our area or across the state/nation and the economy shuts down again. Question #4: If a friend or family member wants to sell AND buy property NEXT YEAR, what should they be concerned about? B.) Not getting a high enough price for their current property - 13 - 33% None of the above. These issues shouldn’t be concerning NEXT YEAR - 10 - 26% C.) Coronavirus/COVID-19 (personal illness or contributing to a second wave of COVID-19) - 7 - 18% Answers A & B - 6 - 15% A, B & C - 3 - 8% A.) Paying too much for their new property - 0% A few notable comments sent by clients: “I do not have high hopes for the future economy. But I am typically a pessimist.” — “next year is so far away it is hard to tell from a pricing standpoint, but a second wave of COVID-19 is very likely to effect next year if we are not careful” — “I suppose it would depend on whether the market gets flooded with listings when we're give the all clear. And whether people will continue to buy. A very low interest rate would certainly stimulate the housing market.” — “We were in a 'tired' bull market nationally this year anyway but our real estate market was strong. ...But if anyone says they are certain about what is going to happen I would say they are smoking something ...” My take: My goal with this question was to gauge respondents attitudes about the future. Well, it turns out most of the people who answered were pretty worried. Only 26% of respondents were feeling optimistic about next year’s real estate market. The truth it, there’s a LOT to worry about, right? Maybe 26% is actually a high number given what were facing! Rules and the interpretation of rules. I guess I should have expected this but I didn’t. The NY on PAUSE rules - as they apply to the real estate market - haven’t changed since last week and yet I have observed a variety of real estate trade associations and real estate companies offering seemingly contradictory advice on how to apply the rules. All this is resulting in differences in how agents are behaving in the real estate marketplace. Some are interpreting the rules to allow for more freedom of action and some are restricting their actions severely as a result of guidance given by their companies and trade associations. Is there any agreement at all? Yes. I have not personally witnessed a real estate agent put another person directly at risk by meeting with a client or consumer in person under the current rules. I have not heard a real estate agent even suggest including a client/consumer on an appointment. There appears to be nearly universal agreement that meeting anyone in person is not permitted. I can tell you from personal experience a seller-client ask me to be present while an “unaccompanied” buyer walks through their property - at a safe social distance. (“Unaccompanied” appointments by buyers are permitted under very limited circumstances.) I declined to be present in the property with the buyer citing widespread agreement that it may be unsafe for all parties and that I was not permitted to do so under NY on PAUSE. I ended up driving out to the property but I did not leave my car. I wanted to provide moral support to my client even if I could not fully accede to their wishes. It is precisely this sort of situation along with a disagreement on the interpretation offered by real estate trade associations that creates pressure to interpret the rules at variance from their strictest application. When a client asks we WANT to provide the service they request and expect. Providing client service is not the only situation leading to variable behavior in the marketplace. The financial pressure agents are under is also likely leading to behaviors that don’t strictly abide. And, as you might expect, I’m certain that are some agents who see their own interests as paramount. Those agents interpret the rules in any way necessary to support their personal benefit. Nothing short of enforcement will stop those agents. The most common and significant area of disagreement appears to be around real estate agents going into properties on their own. If the seller gives informed consent and no one is present in the property, can a real estate agent look inside a property alone? Can an agent go to an empty property alone to take photographs or conduct a virtual tour using FaceTime, Zoom or another similar video conferencing service with the seller’s informed consent? Some say yes. “What’s the harm?” Some say no. “NY on PAUSE says we can’t.” Does it? The experts we rely on don’t agree. It depends how you interpret the language. It should be remembered more people traveling around, more people coming and going from properties all over our area, more activity drives more spread of the virus. If we were talking about one real estate agent looking at one property, the risk to society would be negligible. If we’re talking about HUNDREDS of real estate agents going in and out of HUNDREDS of properties, that’s another matter, right? Until a penalty is levied and then litigated there probably won’t be a definitive answer. Chances are good the rules won’t be around long enough to be litigated. Frankly, I’m doubtful any but the MOST fragrant violations will be enforced. It’s quite likely lesser violations will be tacitly allowed. This is no small matter. Visiting a property in person can make all the difference on a buyer’s decision to submit an offer. No one wants to cause any harm. My sellers and buyers - YOU - want to conduct business, right? I hear it time and time again. The question now becomes what are WE going to do? Indeed. You and I will have to talk through your particular situation to to determine the best course of action with the understanding that there is only so much we can do under these extremely unusual circumstances. In addition to looking at market conditions we will consult the rules, assess the risks and calibrate our actions. We will work together to identify the right path to keep you safe, abide by the rules and accomplish your real estate goals. I give you my promise I will provide you with the highest level of service allowable under the law. Key real estate numbers in Monroe County for single family homes, townhouses and condominiums: The real estate market in 2020:

The real estate market in 2019:

Over the last couple of days the number of new listings and the number of properties under contract ticked up. The 2020 numbers also ticked up as compared to last year over the same period. Still, the number of homes listed is DOWN by more than 55% and the number of properties under contract is DOWN by nearly 75%. Dramatic. In terms of the shear number of transactions, it’s very hard to believe our area will catch up to last year’s totals. Many people who would have liked to purchase and/or property this year will be disappointed. But, just because the number of transactions fall doesn’t necessarily mean property values will fall. It depends on how the supply of available homes compares with the demand. Simple economics. You’ll notice I’ve added a new calculation to my watch list: “Success Rate”. The Success Rate looks at the number of sales divided by the number of properties listed for sale. That calculation results in a percentage. I’ll compare the success rate in 2020 to the success rate in 2019 from now one. The Success Rate in 2020 compared to 2019 is much lower. Translated that means the supply of homes has been out pacing sales as compared to 2019, at least for now. Our Personal Status.

I will continue to post updates related to the metro Rochester real estate market during the coronavirus. The situation is changing rapidly. You deserve the most recent information about our real estate market from a source you trust. I wish you and your loved ones good health and good spirits during this unfortunate crisis! Yours, Rome Celli 585-732-1767 romecelli@realtor.com

The number of days that have passed since the beginning of the New York on PAUSE (March 23, 2020)

Over the last twenty-two days I’ve posted nine reports about how the coronavirus pandemic has affected the real estate market in our area. Now it's time for you to let me know what YOU think. Today’s post includes a quick anonymous survey. I'll post what I learn from you in a future report. The real estate market activity in Monroe County appears to be drifting downward since the most recent set of rules under the NY PAUSE executive order were promulgated last week. Property listings are down and so are accepted contracts. Is it a buyers’ market? See the numbers below. As always, I am available to talk privately with you about your particular real estate situation. Call, text or FaceTime: 585-732-1767. Email: romecelli@realtor.com I'm hosting a Zoom meeting to answer your general questions and talk about the local real estate market. Thursday, April 16, 2020 at 7:00 pm - CLICK HERE TO JOIN THE MEETING Meeting ID: 585 732 1767 Password: 625369 Key real estate numbers in Monroe County for single family homes, townhouses and condominiums: The real estate market in 2020:

The real estate market in 2019:

Sellers beware. The average daily number of newly listed properties and the average daily number of properties under contracts have both drifted down slightly since the most recent restrictions have been put back into place last week. The daily average of newly listed properties has been fluctuating between approximately 13 and 16 since Gov. Cuomo signed the New York PAUSE executive order on Monday, March 23, 2020. The daily average of properties under contract has fluctuated between about 3 and about 6 since March 23, 2020. The comparison between 2019 and 2020 speaks loudly and clearly about market conditions under NY PAUSE. Housing inventory is very, very low. The really striking thing is even as low as inventory is at the moment the pace of sales is even lower. In other words, if the current trend continues the market will turn from a strong market for sellers to more of a balanced market for buyers and sellers and may even drift into a market more favorable to buyers. My sense is while potential property buyers are learning and adapting to virtual real estate they are not willing to take on the risks associated with buying virtually or they are not willing to work through a real estate transaction during the crisis for personal and societal health reasons. If buyers believe the crisis is heading towards a foreseeable conclusion, they may just stay on the sidelines until the fears and risks of buying homes more-or-less unseen passes. If I’m right, it will get harder to sell before it gets better. I haven’t broken down the numbers geographically but I’m willing to bet there are some areas around Monroe County that have already moved in the direction of buyer advantage. Sellers beware. How will we know the real estate market is shifting? Well, we won’t see actual sales prices for many weeks. Sales prices are not reported until after transactions close. However, there are some symptoms that will be apparent in real time: the percentage of properties that sell will continue to drop; the number of days properties stay on the market will rise; and the number of properties that drop off the market unsold will increase. Our Personal Status.

I will continue to post updates related to the metro Rochester real estate market during the coronavirus. The situation is changing rapidly. You deserve the most recent information about our real estate market from a source you trust. I wish you and your loved ones good health and good spirits during this unfortunate crisis! Yours, Rome Celli 585-732-1767 romecelli@realtor.com

|

Rome CelliCelebrating over 35 years of commitment to real estates in every corner of our community!

|

||||||||||||||||||||||||||||||||||||

RE/MAX Realty Group | 10 Grove Street | Pittsford, New York 14534 | 585-248-0250